Digital Loan Application

Description

Live Oak Bank

8 Jan 2024

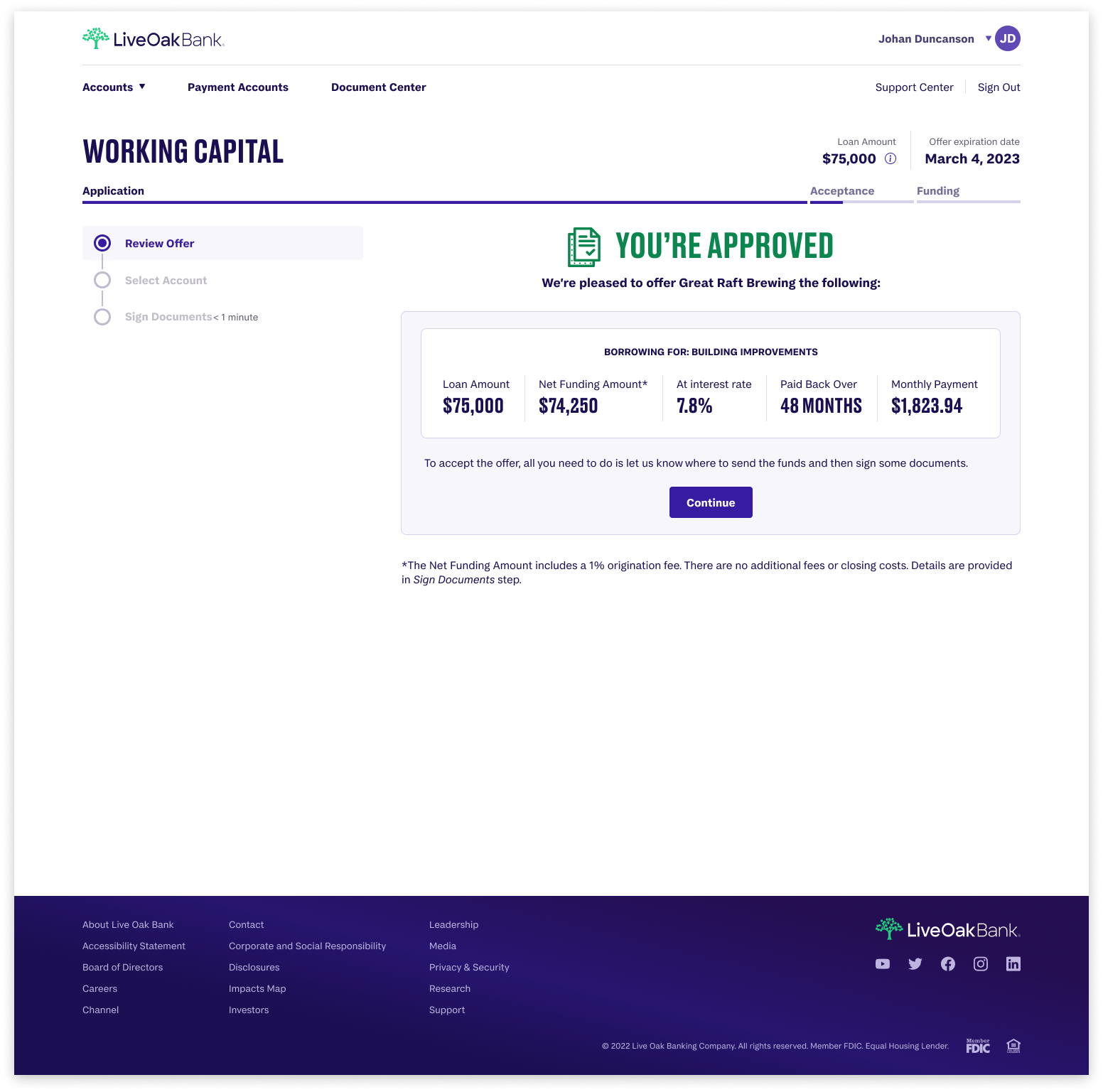

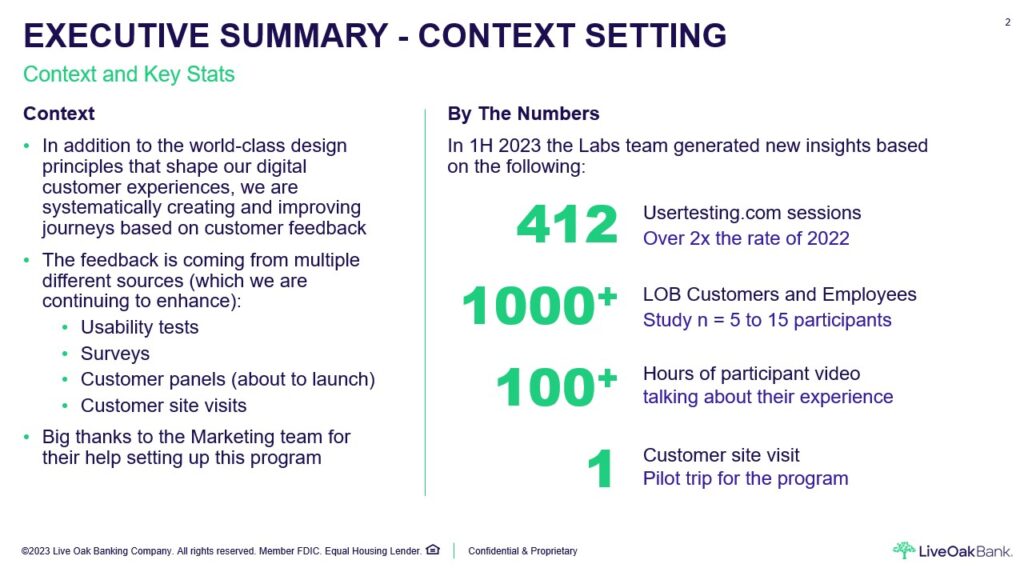

New SBA rules allow for new entrants into small dollar lending. Live Oak Bank must quickly build a loan product pipeline to maintain the competitive moat.

Role

- Head of CX leading a team of 7

- Cross-functional alignment with partners

- Accountability for design outcomes

Business Goals

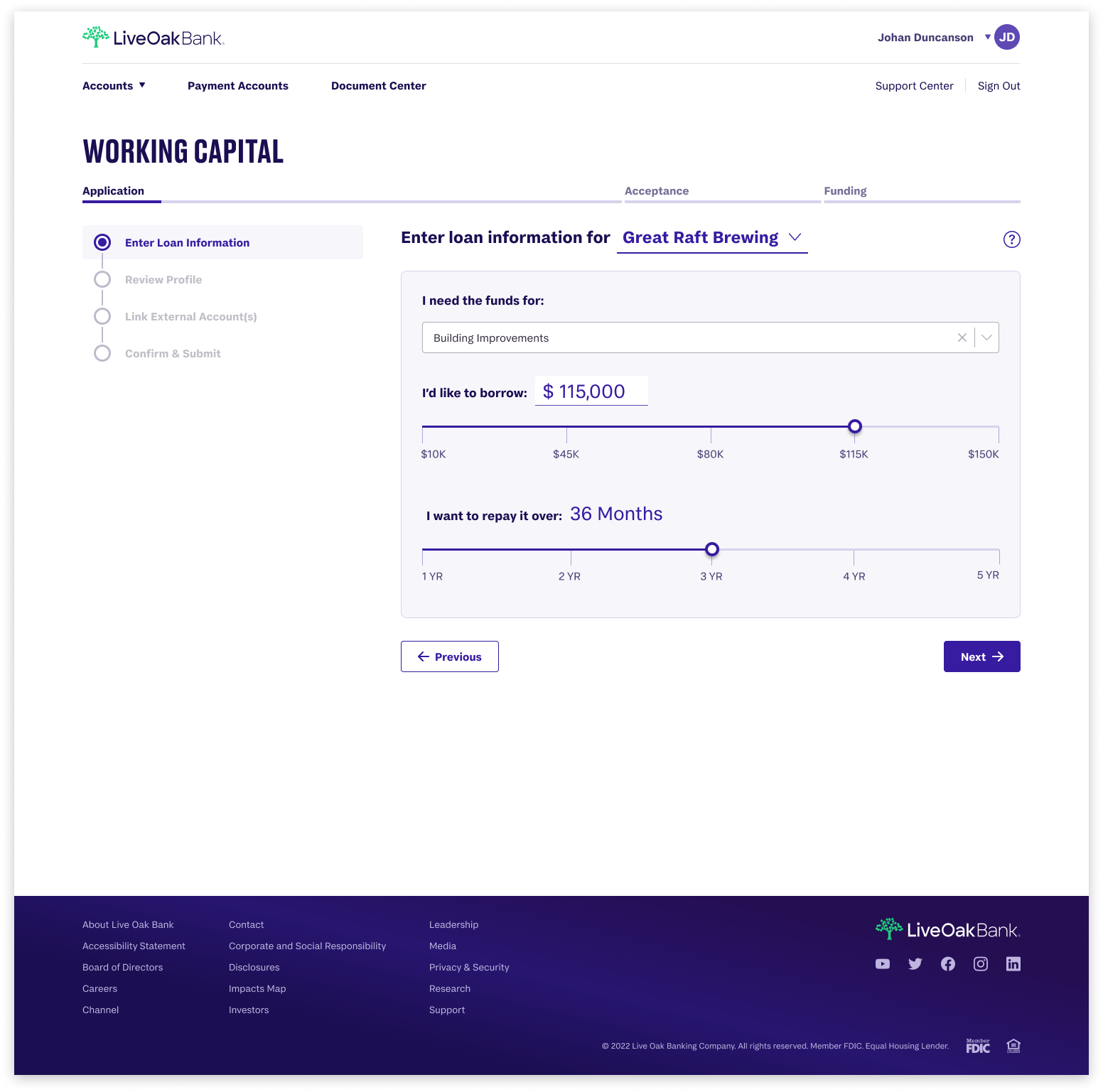

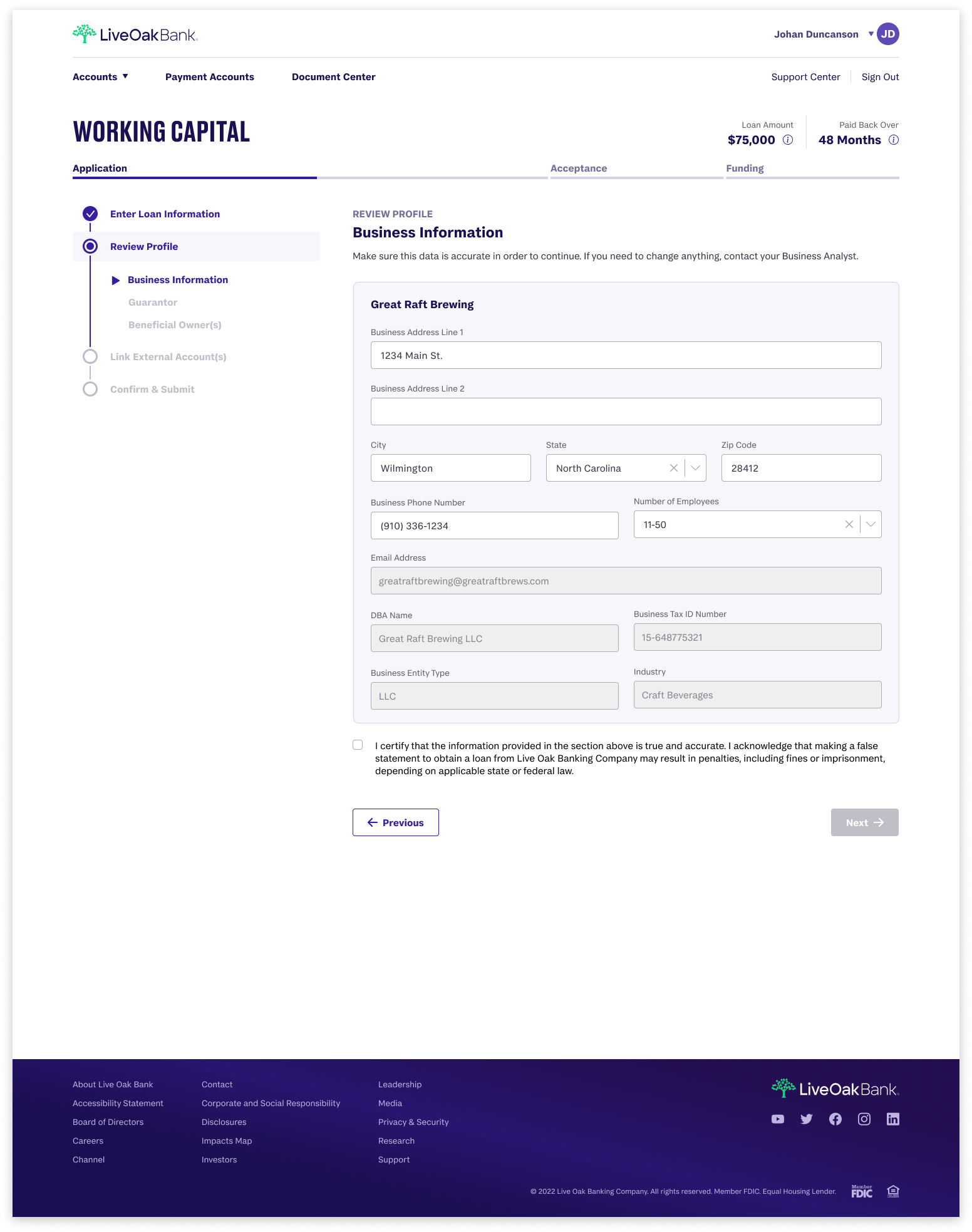

- Turn the new rules into a line of business

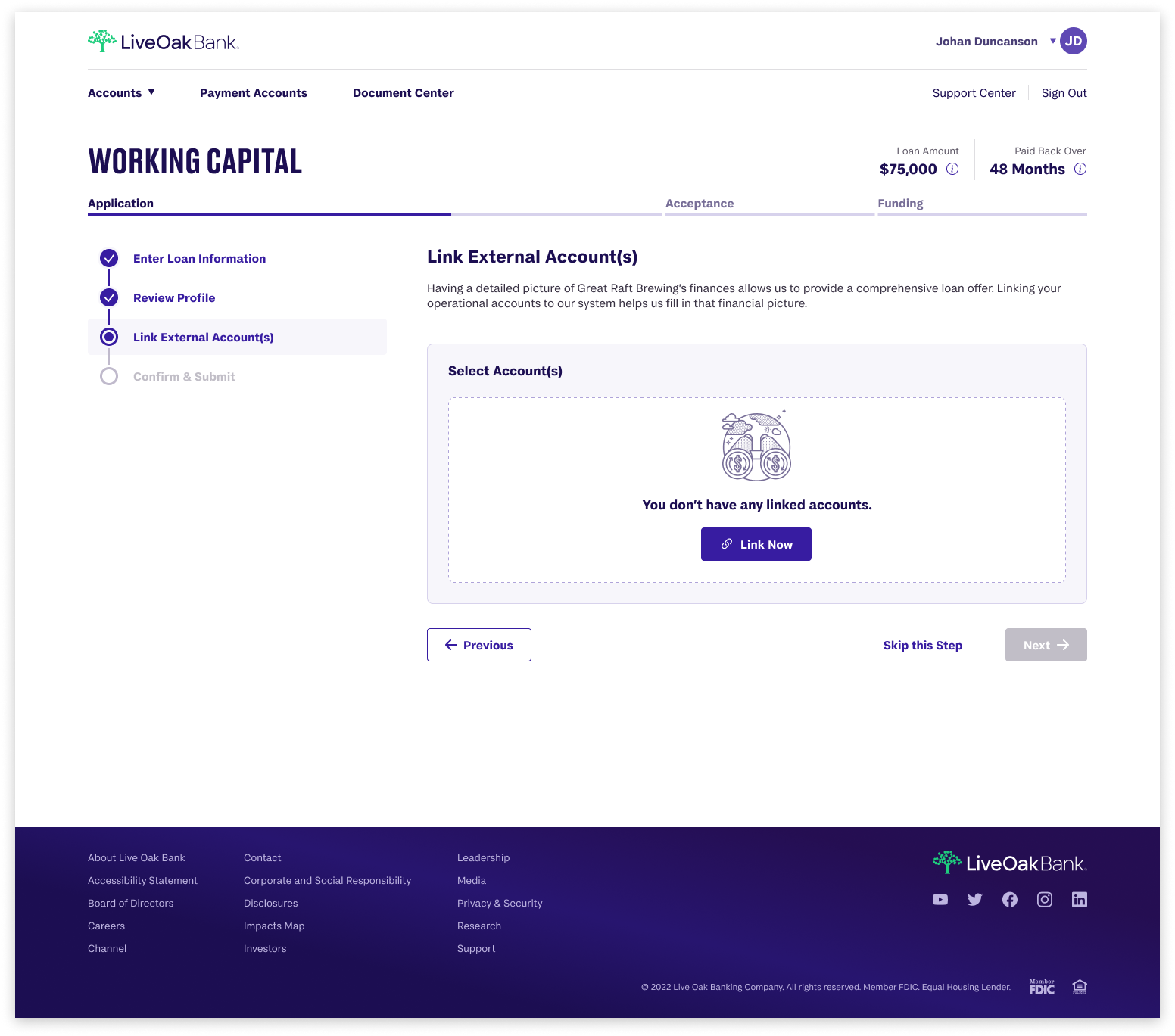

- Leverage automation and third party APIs

- Build it on Finxact, a real-time Core

- No additional capacity or headcount